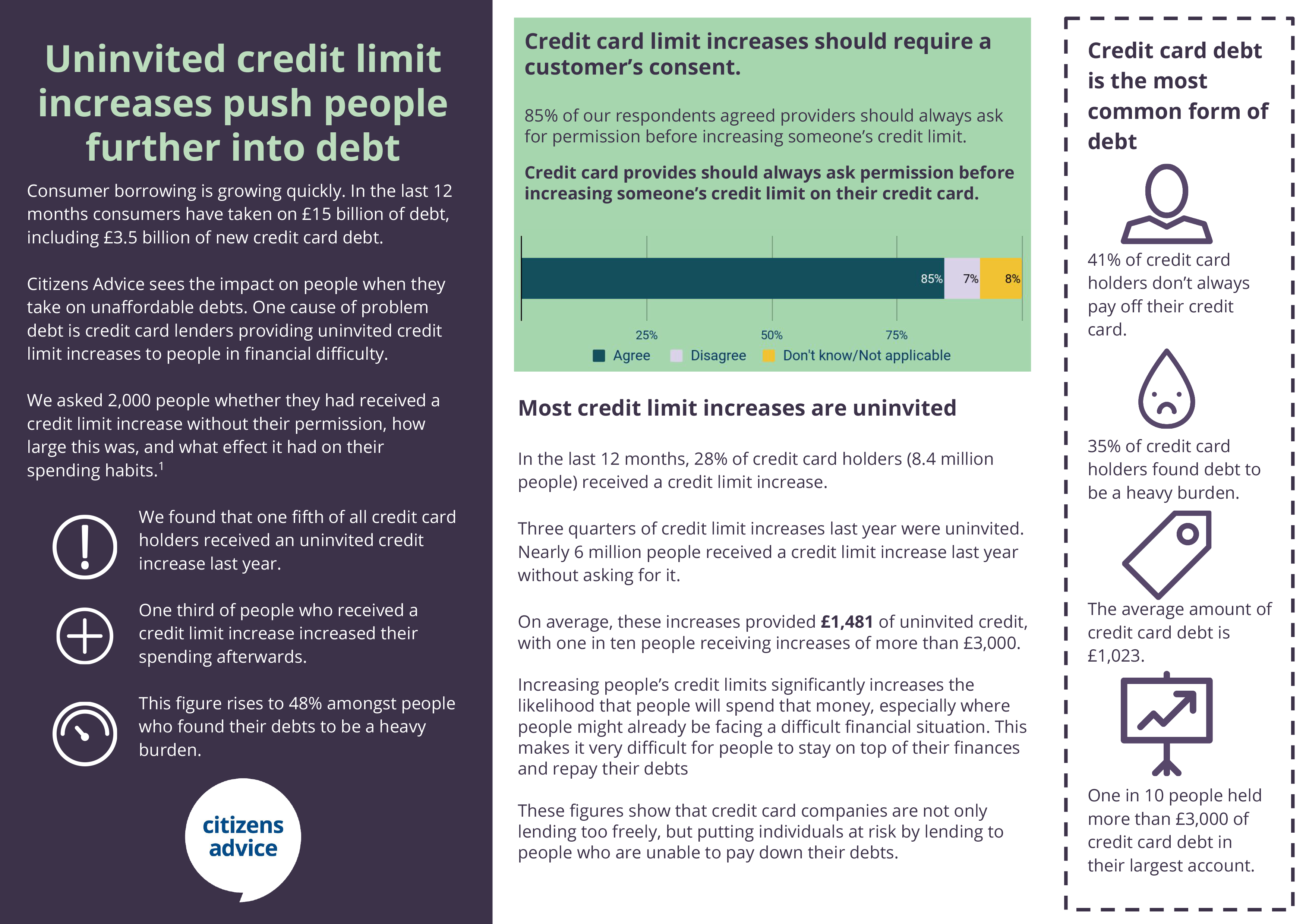

Uninvited credit limit increases push people further into debt

Consumer borrowing is growing quickly. In the last 12 months consumers have taken on £15 billion of debt, including £3.5 billion of new credit card debt.

Citizens Advice sees the impact on people when they take on unaffordable debts. One cause of problem debt is credit card lenders providing uninvited credit limit increases to people in financial difficulty.

We asked 2,000 people whether they had received a credit limit increase without their permission, how large this was, and what effect it had on their spending habits.

We found that:

One fifth of all credit card holders received an uninvited credit increase last year.

One third of people who received a credit limit increase increased their spending afterwards.

This figure rises to 48% amongst people who found their debts to be a heavy burden.

We are calling on the government and the FCA to ban uninvited credit limit increases so people aren’t put at risk of taking on debts they can’t pay back.